Who Needs an LEI?

Key takeaway: The need for a Legal Entity Identifier (LEI) primarily depends on regulatory requirements within specific jurisdiction: The country or legal area whose laws and regulations apply to an entity or activity. and the nature of an entity's financial activities, especially involving transactions like securities trading, derivatives: Financial contracts (e.g., forwards, futures, swaps, options) whose value is derived from an underlying asset, rate, index, or other reference., and regulatory reporting.

On this page

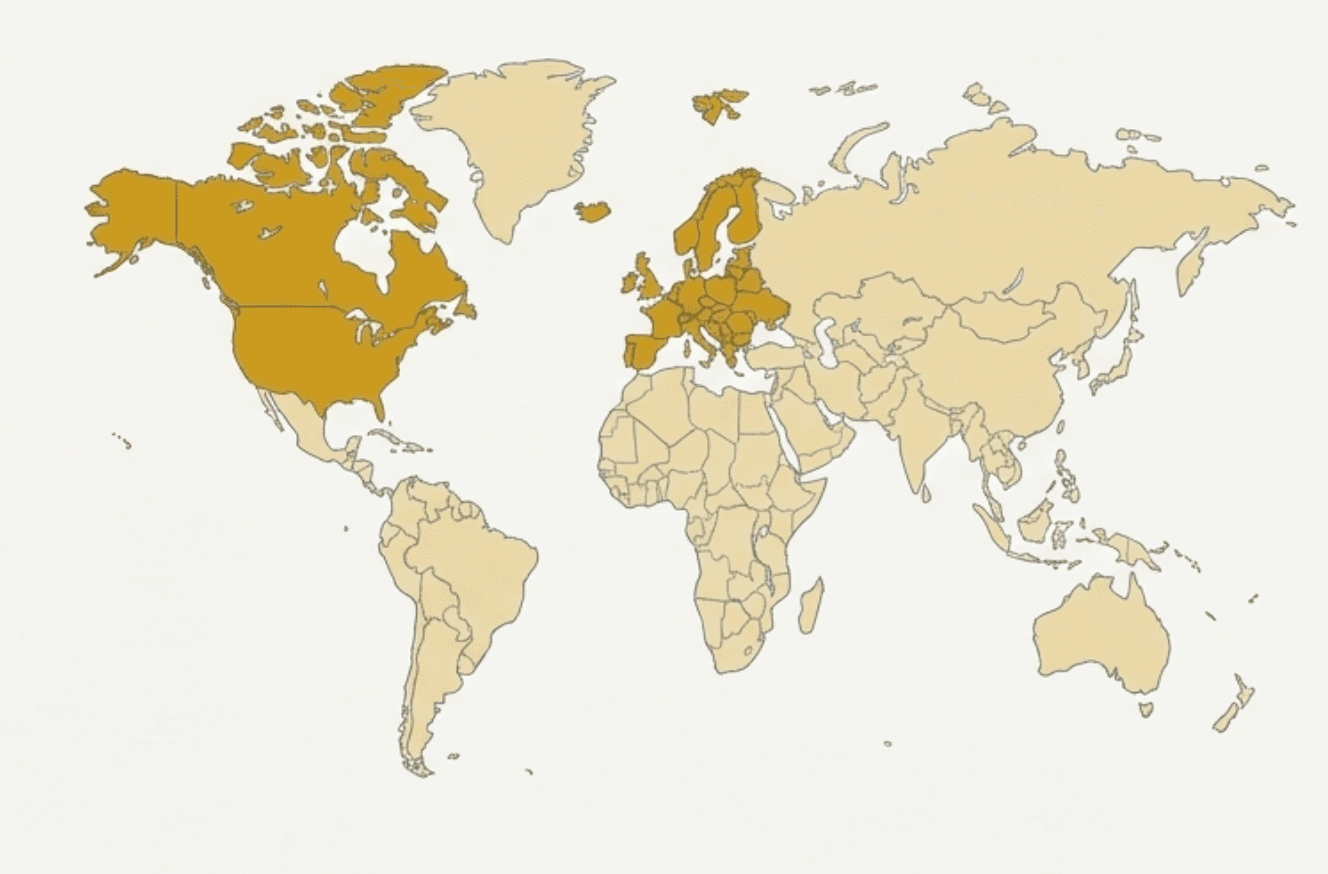

Understanding the Global Scope of Legal Entity Identifier Requirements

Introduction

The Legal Entity Identifier (LEI) is more than just a 20-character alphanumeric code—it is a critical component of modern global finance and regulatory transparency. Whether you're a multinational investment firm or a small company with occasional securities dealings, understanding whether you require an LEI is essential to avoid regulatory disruptions and ensure compliance.

This guide answers the question “Who needs an LEI?” with clarity, precision, and examples, so you can determine your obligations with confidence.

What Is an LEI?

An LEI (Legal Entity Identifier) is a unique, publicly accessible code assigned to legal entities participating in financial transactions. Managed under the Global Legal Entity Identifier System (GLEIS: GLEIS (Global LEI System) — the global framework of rules and institutions that supports issuing and publishing LEIs.) and supervised by the Global Legal Entity Identifier Foundation (GLEIF: GLEIF — the organization that coordinates the global LEI system and maintains data quality in the Global LEI Index.), the LEI links an entity to verified reference data—its legal name, address, registration number, and ownership structure.

Entities That Require an LEI

The need for an LEI typically arises from regulatory mandates or participation in regulated financial markets. Below is a breakdown of entities most commonly required to obtain an LEI:

1. Financial Institutions

Banks, investment firms, insurance companies, and asset managers are almost universally required to have an LEI under regulations such as:

- MiFID II: MiFID II — an EU directive regulating financial markets, including transaction reporting and entity identification requirements (e.g., LEI usage). / MiFIR: MiFIR — an EU regulation accompanying MiFID II, directly applicable and covering, among other things, transaction reporting rules. (EU)

- Dodd-Frank Act: Dodd-Frank Act — a U.S. post-2008 financial reform law, including derivatives market reporting and oversight requirements. (US)

- EMIR: EMIR — an EU regulation focused on derivatives (especially OTC), including mandatory reporting to trade repositories. (EU)

- FCA Regulations (UK)

- MAS Reporting (Singapore)

If your institution issues or trades securities, derivatives: Financial contracts (e.g., forwards, futures, swaps, options) whose value is derived from an underlying asset, rate, index, or other reference., or foreign exchange instruments, an LEI is mandatory.

2. Corporate Entities

Any company involved in financial transactions—especially those engaging with:

- Stock exchanges

- Bonds and fixed income markets

- derivatives: Financial contracts (e.g., forwards, futures, swaps, options) whose value is derived from an underlying asset, rate, index, or other reference.

- Cross-border payments

- Trade finance instruments

Private limited companies, public corporations, subsidiaries, and even non-listed firms may require an LEI depending on the nature of their activities and regulatory jurisdiction.

3. Investment Funds and Fund Managers

LEIs are often required for:

- Collective Investment Vehicles (UCITS: UCITS — an EU regulatory framework for retail investment funds., AIF: AIF (Alternative Investment Fund) — an investment fund that is not a UCITS fund.)

- Pension funds

- Fund administrators

- Trusts (depending on jurisdiction)

Fund-level LEIs are frequently needed to report transactions independently of the fund manager.

4. Government Entities and Non-Profits

Even non-commercial legal entities may need an LEI when:

- Issuing or holding securities

- Participating in derivatives: Financial contracts (e.g., forwards, futures, swaps, options) whose value is derived from an underlying asset, rate, index, or other reference. markets

- Reporting under regulations like SFTR: SFTR — an EU regulation on reporting securities financing transactions (e.g., repos, securities lending). or EMIR: EMIR — an EU regulation focused on derivatives (especially OTC), including mandatory reporting to trade repositories.

Examples include municipalities issuing bonds or state-backed institutions participating in capital markets.

5. Trusts and SPVs

While individuals are not eligible for LEIs, trusts, foundations, and special purpose vehicles (SPV: SPV (special purpose vehicle) — a legal entity created for a specific project or financial structure.) often must register if they engage in financial transactions or reporting.

Some jurisdictions consider fiduciary structures like trusts as legal entities, requiring LEIs based on financial reporting frameworks.

When Is an LEI Mandatory?

LEIs are required under specific use cases. If your organization engages in any of the following, you likely need an LEI:

| Use Case | LEI Requirement |

|---|---|

| Trading stocks, bonds, or ETFs | ✔️ Yes |

| OTC: OTC (over-the-counter) — transactions negotiated off-exchange, directly between parties or via a broker. derivatives: Financial contracts (e.g., forwards, futures, swaps, options) whose value is derived from an underlying asset, rate, index, or other reference. reporting | ✔️ Yes (EMIR: EMIR — an EU regulation focused on derivatives (especially OTC), including mandatory reporting to trade repositories., Dodd-Frank Act: Dodd-Frank Act — a U.S. post-2008 financial reform law, including derivatives market reporting and oversight requirements.) |

| SFTR: SFTR — an EU regulation on reporting securities financing transactions (e.g., repos, securities lending). transaction reporting | ✔️ Yes |

| Cross-border payment messages (ISO 20022) | ✔️ Strongly Recommended |

| Filing with financial authorities (e.g., ESMA, FCA) | ✔️ Yes |

| Holding securities in custody | ✔️ Often required |

| Issuing corporate debt | ✔️ Yes |

What If You Don't Have an LEI?

Without an LEI, your institution may face:

- Rejection of trade orders on regulated platforms

- Regulatory penalties or non-compliance flags

- Exclusion from custody, clearing, or settlement systems

- Inability to report trades or fulfill transparency obligations

Many trading venues now enforce a strict “No LEI, No Trade” policy.

Who Does Not Need an LEI?

Entities generally NOT requiring an LEI:

- Private individuals

- Sole proprietors not participating in financial markets

- Entities not engaging in regulated financial transactions

That said, even non-obligated entities may voluntarily obtain an LEI to:

Reasons for voluntary LEI registration:

- Improve transparency

- Prepare for future compliance

- Strengthen credibility with financial partners

Final Word: When in Doubt, Verify

Given the evolving nature of global regulations, it's essential to verify whether your jurisdiction: The country or legal area whose laws and regulations apply to an entity or activity. or counterparty: The other party to a transaction (e.g., a bank, fund, or company) that enters into the financial agreement with you. require an LEI for specific activities.

If you're uncertain, consult your legal advisor, financial regulator, or registration agent to determine if your entity should obtain an LEI now—or risk transaction delays later.

Glossary (14)

- jurisdiction

- The country or legal area whose laws and regulations apply to an entity or activity.

- counterparty

- The other party to a transaction (e.g., a bank, fund, or company) that enters into the financial agreement with you.

- derivatives

- Financial contracts (e.g., forwards, futures, swaps, options) whose value is derived from an underlying asset, rate, index, or other reference.

- OTC

- OTC (over-the-counter) — transactions negotiated off-exchange, directly between parties or via a broker.

- EMIR

- EMIR — an EU regulation focused on derivatives (especially OTC), including mandatory reporting to trade repositories.

- MiFID II

- MiFID II — an EU directive regulating financial markets, including transaction reporting and entity identification requirements (e.g., LEI usage).

- MiFIR

- MiFIR — an EU regulation accompanying MiFID II, directly applicable and covering, among other things, transaction reporting rules.

- SFTR

- SFTR — an EU regulation on reporting securities financing transactions (e.g., repos, securities lending).

- Dodd-Frank Act

- Dodd-Frank Act — a U.S. post-2008 financial reform law, including derivatives market reporting and oversight requirements.

- GLEIS

- GLEIS (Global LEI System) — the global framework of rules and institutions that supports issuing and publishing LEIs.

- GLEIF

- GLEIF — the organization that coordinates the global LEI system and maintains data quality in the Global LEI Index.

- UCITS

- UCITS — an EU regulatory framework for retail investment funds.

- AIF

- AIF (Alternative Investment Fund) — an investment fund that is not a UCITS fund.

- SPV

- SPV (special purpose vehicle) — a legal entity created for a specific project or financial structure.

Next Steps

Understanding who needs an LEI is the first step. Learn more about the process involved: